IT is widely recognised that the Australian private hospital insurance (PHI) sector is in trouble, with younger customers abandoning insurance. Young people are not getting value for money, and subsidise older generations. Other countries with similar PHI allow private insurers to charge less for the young than the old (for example, in the US). It is important that premiums should not vary by pre-existing medical conditions, but perhaps it is time to consider age-based premiums in Australia.

PHI is getting into a “death spiral”: the young and healthy are dropping out; and those left are older and more likely to use services, driving insurance premiums up further, and then more young consumers drop out. This vicious cycle continues until PHI is out of business.

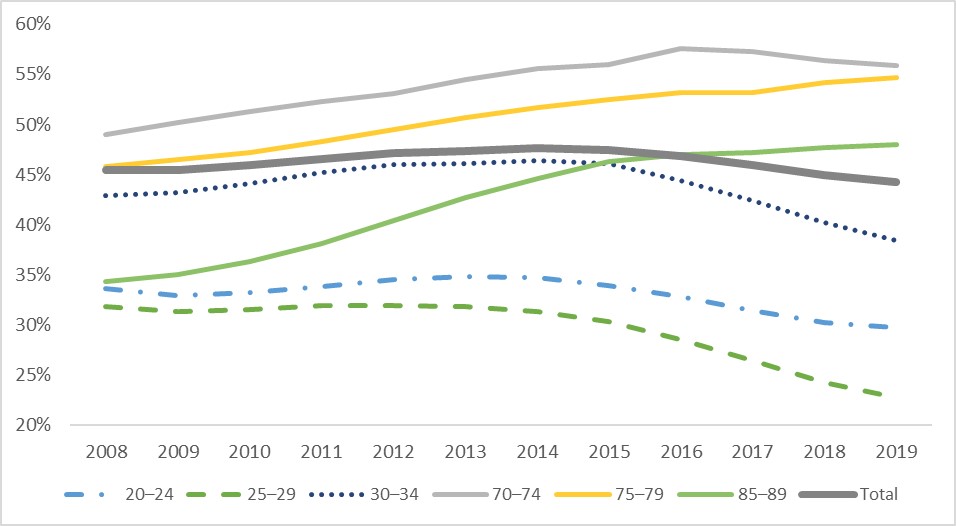

In June 2020, 44% of all Australians held PHI, but uptake rates vary substantially by age, ranging from 22% among those aged 25–29 years, to 56% among those aged 70–74 years. In the past 5 years rates of PHI enrolment dropped the fastest among young people aged 20–34 years and increased the fastest among older people aged 70 years or older (Figure 1).

Figure 1. Trends in the proportion of Australians having private hospital insurance, by age cohort

Sources: The author’s calculation. There are two types of private health insurance: private hospital insurance and general treatment (ie, extra care including dental, optical, physiotherapy). This article focuses on private hospital insurance because it is much more expensive than extra care and is targeted by all current private health insurance regulations. Number of insured population by age cohort are from the Australian Prudential Regulation Authority’s quarterly private health insurance statistics June 2020 issue released on August 18, 2020. Population size by age cohort is from the Australian Bureau of Statistics’ Australian Demographic Statistics census survey.

Young people drop PHI because they are not getting value for money from purchasing it. The latest PHI statistics report by the Australian Prudential Regulation Authority showed that average hospital benefits per person in the year up to June 2020 were $550 for those aged 20–24 years, $740 for those aged 25–29 years, and over $6800 for those aged 85–89 years. In Australia, PHI premiums are set as community rating, so people pay same premiums regardless how much hospital care they use.

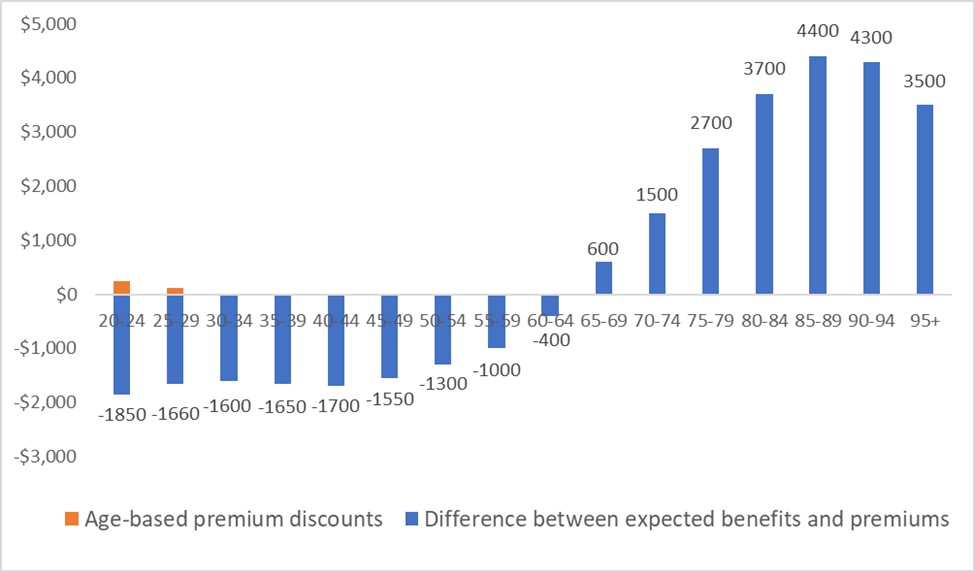

Figure 2 presents the difference between average hospital benefits and premiums from holding PHI per person per year for the year from July 2019 to June 2020, by age cohort. Clearly, the rational decision for the young is not to purchase PHI, if there were no government interventions.

Figure 2. Difference between expected hospital benefits and premiums from purchasing private hospital insurance per person for the year from July 2019 to June 2020, by age cohort

Sources: The author’s calculation. Numbers shown on the bars are the difference between value and costs from purchasing private hospital insurance per person for the year from July 2019 to June 2020. Hospital treatment benefits per person per year are from the Australian Prudential Regulation Authority’s quarterly private health insurance statistics June 2020 report (page 7). Because people are risk averse and they will gain value from purchasing insurance to protect their risk, but we do not have this data. However, young people may be less risk-averse than older people, so the value from risk protection is lower for the young. Thus, if the value from risk protection were included, the difference in benefits between the old and the young would be larger. Costs of private hospital insurance presented here only include premiums and do not include out-of-pocket payment at the time of services delivered. Premiums for hospital coverage range from $1200 to $3600 per year per person depending on coverage generosity (The Commonwealth Ombudsman. Compare Policies. 2020;. viewed August 28 2020). The middle point of $2400 is used as costs to plot this figure. The age-based premium discounts for 18–29 years are applied to age groups 20–24 years and 25–29 years. The allowable discount is 2% for each year when a person is aged under 30 years, ranging from 2% for 29 years, 4% for 28 years, to a maximum of 10% for 18–25 years of age.

In 1997–2000, three main policies (here, and here) were implemented in Australia to encourage people to sign up for PHI:

- rebates are provided to those who buy private hospital insurance (higher rebates for people older than 65 years of age from 2005; rebates became means tested in 2012);

- Medicare Levy Surcharge charges additional tax for people who earn above a certain threshold and do not hold private hospital cover; and

- Lifetime Health Cover penalises young people who do not hold private hospital insurance after they turn 31 years by increasing their premiums.

Initially, these government interventions were effective in increasing uptake rates of private hospital insurance from 30% to 45%. However, these policies were implemented with high costs to taxpayers, and have recently become ineffective in increasing the PHI enrolment (here, and here). Further, the latter two are controversial. Why should private insurance be compulsory when all Australians have Medicare to cover their health care (here, and here)?

Instead of punishing the young who make rational decisions, policy makers should consider a more effective approach to increase value of PHI for the young.

Recently, the Australian government allowed insurers to offer people aged 18–29 years discounts of up to 10% of their premiums starting from 1 April 2019. Over a year later, young people still experienced the largest decline in private hospital coverage. It is possible that the young are affected most by the COVID-19 pandemic financially and have trouble affording PHI now. More young people may buy PHI after the pandemic is over. However, premium discounts are very small compared with the large difference between expected benefits and premiums for the young (Figure 2). Thus, it is unlikely that age-based discounts will solve the problem.

One possible solution is to allow premiums to vary by age. Age-based premiums have been used in other countries. For example, in the US marketplace, premiums vary based on five factors. Like in Australia, premiums vary by plan tier (higher premiums for gold plans than bronze plans), location, and individual versus family enrolment. However, marketplace plans can also vary premiums by age and tobacco use: premiums can be up to three times higher for older people than for younger ones; and tobacco users face up to 50% higher premiums. Similarly, private insurers in the UK can charge more for older people (especially for those aged over 50 years) than young people, and more for smokers than non-smokers.

The new policy should make PHI valuable for all Australians by allowing premiums to align more closely with expected benefits. Some may worry that older people cannot afford high premiums even though the product is valuable to them. For those who cannot afford PHI, the government can continue to subsidise their premiums, as currently people aged over 70 years receive rebates to cover 40% of their premiums.

Young Australians are facing more challenges than the old: long term impact from climate change, increasing house prices, and the recent economic downturn due to COVID-19, just to mention a few. On top of all these, the young also subsidise the old when it comes to PHI.

Efficiency and fairness both suggest that it is time to consider age-adjusted premiums for PHI.

Professor Yuting Zhang is Professor of Health Economics in the Faculty of Business and Economics at the University of Melbourne, and an expert on economic evaluations of health policy and health care reforms.

The statements or opinions expressed in this article reflect the views of the authors and do not represent the official policy of the AMA, the MJA or InSight+ unless so stated.

more_vert

more_vert

I have never minded paying for health insurance however i do get fed up with the out of pocket expences that are going up and up. Hardly any No Gap Specialists anymore. Then once in hospital x ray and Pathology can have charges. No wonder people are leaving it. Also the loading is exorbitant as my husband was not in health insurance for a number of years so tge extra 30% is enormous.

To the young – get a grip. This is insurance. Do you insure your car ? Do you insure your house ? If so why ?? You are not hoping to get “Value ” out of those insurances surely !! Same applies to Health Insurance. If you are not getting value for money then you are well. Just as your house hasn’t burnt down or your car been crashed.

And Ian Hargreaves is spot on – tear your ACL at footy, wreck your thumb skiing, dislocate your shoulder skateboarding …. you will get value for money then alright with rapid access to restore the anatomy and back to life and work.

I’m another who has been covered all my life by private insurance first by my parents and then by myself. In the 1950s my father, an SA Railways clerical officer, was a member of two funds (NHSA and the SA Railways Union fund) because in those days membership was high high and so premiums were low and he could afford to join two independent funds and claim off both under the rules then. Having paid for health insurance myself for over 50 years I would resent being thrown to the wolves by Dr Zhang’s philosophy forcing me to lose the benefits of my lifetime investment by rendering continued fund membership not affordable for me.

‘Private’ health insurance is not really private when the government provides a tax rebate for it. The private health insurance tax rebate is the worst health policy in thirty years. It has failed to achieve its intended aims and it is inequitable in providing greater benefits to the rich than to the poor.

The billions of dollars of public revenue foregone because of this policy should be restored by cancelling the private health insurance tax rebate and using the money to improve our public health and health care facilities, including the improvement of general practice, which saves multiples of the funding invested in it.

Private health insurers should then be allowed to offer whatever policies they wish without being regulated by government.

Slippery slope to starting to charge more for pre-existing conditions. Get rid of public subsidy for PHI (and possibly MBS rebates for private procedures/consults) and use the savings to boost Medicare. Patients who can afford to do so can still pay to jump the queue, just not on taxpayer dollar.

Thanks for attempting to throw us older folk under the bus Professor Zhang! Many of us have spent many thousands of dollars on health insurance over decades and ought not expect to pay even more because we are older!

Not very impressed by the mantra of “poor young people “ and the victim mentality . I would expect most “ older“ people to drop out health insurance because they won’t be able to afford it even though many will have paid premiums , for which they do not get government assistance, their whole lives. The elephant in the room here is the extortionate gaps that some private specialists demand to be paid. The premiums should cover the cost of care

For an economist, Prof Zhang has some strange ideas.

You pay taxes when you are young, fit, and employed; you draw a pension and use more publicly funded healthcare when you are old, sick, and retired.

The graph in Fig.2 is a flat line for the average person’s lifetime. It has to be, by definition, as ‘benefits paid’ has to equal ‘premiums paid’, on average (plus admin costs, profit margins etc).

As I regard myself as rational, I would dispute the assertion that: “the rational decision for the young is not to purchase PHI”. Having paid for private health insurance all my working life, I did so knowing that as a self-employed manual worker, and sole family breadwinner, it was important to me to get expeditious and expert care.

A knee ligament injury in a roofer, a trigger finger in a musician, a hernia in a storeman, carpal tunnel syndrome in a surgeon – these are all career-threatening conditions, which are category 3 non-urgent in the public sector.

Perhaps the greatest failing of our profession as a whole in advocating PHI has been in sheepishly covering up the deficiencies of the public sector – none of the patients with the conditions above would be likely to get a public specialist clinic appointment within their 2 weeks’ annual sick leave period. Even worse, for the self-employed tradie/musician/surgeon, every day’s delay is lost income. Then after a long delay, the surgery is done by a trainee, who may be doing their first operation of this kind. Given the rotations of training programmes, the trainee may be allocated to a job in which he has no interest or aptitude, e.g. as a budding hand surgeon, I was required to do terms of knee surgery to get my basic orthopaedic FRACS.

There are many publications which show higher complication rates for trainee surgery than for expert surgery, those who have been to a symphony orchestra concert and a primary/high school concert, will readily understand the benefit of aptitude and experience.

If a GP rings me to say: “I’ve got a carpenter who’s got a skier’s thumb from work. He’s self-employed and can’t hold his tools.” I will see him tomorrow and operate this week. This minimises his total time off work, and gives him access to an experienced surgeon, so he is less likely to get a neuralgic scar or a failed repair, than if my junior registrar does it.

Unfortunately, Prof Zhang’s recommendation will push all the older folk out of PHI and onto public waiting lists, paradoxically worsening public hospital access for the young poor/unemployed patient who still can’t afford PHI, but can’t work till his ligament/hernia is fixed.

The professor seems to overlook that older people are on fixed and/or low incomes as they are no longer working. The loss of community rating combined with higher medical requirements would result in private health insurance fees beyond the income of most retirees except for the top 1 or 2 percent, effectively terminating private health insurance for the majority of the older population. The result would essentially be self insurance, and if any complications arose during private hospital treatment they would then be dumped back into the public hospital system once their ability to pay was reached. That in turn results in patients waiting longer for treatment in the public hospital sector. Not a desirable outcome in my opinion.

There are two main problems. One is the commercialisation of health insurance and their corruption of the previous system of not for profit mutual care organisations resulting in convincing people with marketing about looking for a “good” deal and ignoring that their health is far more important than a flash new car or clothes that they can get on a “special” discount, this month only! The other problem is the loss of community inclusiveness, which has been accelerated by the use of social media in my opinion. Rather than bringing people together for good it has instead enabled the haters and dividers in the world to disrupt not only their own community but others around the world, while protecting them by ensuring their anonymity and freedom from the consequences of their actions, no matter how vile. You need look no further than the POTUS to gauge how effective toxic messages can be to a society and how quickly good institutions can be dismantled and become non functional using the mantra of what’s in it for me, screw them!

The example of the US health system is appalling to anyone who supports universal health care. I don’t think things are that good in Britain either with the NHS guaranteeing generally poor access to healthcare, especially choice of doctor you feel you can trust and location. I know there are surgeons and physicians who I definitely do not want to treat me, even though I would be comfortable with most of them. Australia has been in a sweet spot with the private and public health care balance, and convincing younger people that being involved with private insurance is a good investment in the short term because it will pay off with greater rewards in the long term when they will have higher medical requirements is paramount. Essentially it is pay now or it won’t be there for you later when you need or want it as the system will have collapsed, and the public system will be overwhelmed. Same principle as paying off a mortgage to ensure housing security in the future rather than paying rent and only having short term security. People still aspire to owning their own home despite the early cost and commitment.

Healthcare will always be needed and so I am concerned, less for myself than the succeeding generations of my family, friends and society. The true monetary cost of the pandemic will dwarf the petty squabbles about the value of private health insurance and yet the general community support for limiting the deaths despite the horrendous cost remains.

Please don’t destroy something which cannot be restored unless you are certain there is a better option.

I have been covered with health insurance first under my parent’s policy and then under my own for over 60 years. Until recently my claims have been trivial. At age 80 I have had my first major claim. I have paid in much more than I have received. I appreciate that I have been supported by my insurer when I needed it most. This is insurance! You buy home and property insurance, hoping that the house won’t burn down, but if it does, you are protected. I would be delighted if I never had to make claim. The fact that my premiums go to support others in the pool who are less fortunate is not an issue. The young will grow older, and their attitude to health insurance will change from one of selfish self interest to resentful entitlement.

Regrettably there are some specialists who are openly telling prospective patients to buy insurance, wait out the waiting period, have their surgery, and then cancel the policy. This is shameful behaviour on the specialist’s part and unethical to boot. It may even constitute a conspiracy to defraud.

Perhaps it is time to do away with private health insurance and attach it to basic Medicare as an opt-in paid higher level of cover in the hope that Medicare won’t screw it up.

Have you considered for how many years the aged person has paid the insurance premium????