Repealing the smokefree Act in Aotearoa New Zealand preserves the tobacco excise as a revenue stream for the country’s government but also benefits the tobacco industry.

Against strong recommendations from Māori organisations and global public health authorities, on 28 February, the incoming Aotearoa New Zealand coalition government repealed the Smokefree Environments and Regulated Products (Smoked Tobacco) Amendment Act 2020 (the smokefree Act) (here).

This world-first legislation, passed in December 2022 by the previous government, aimed to achieve a “tobacco endgame” by rapidly reducing smoking rates to minimum levels (< 5%) for all population groups (both Māori and non-Māori). The legislation was the result of decades of Māori leadership and the work of generations of tobacco-control researchers and advocates in Aotearoa New Zealand and globally.

It included three key strategies:

- reducing the nicotine content of tobacco products to non-addictive levels (ie, denicotinisation);

- a 90% reduction in the number of tobacco retailers; and

- creating a “smokefree generation” by making it illegal to sell cigarettes to people born after 2008.

Our modelling of the potential health impacts of the smokefree Act showed that it was likely to deliver large health benefits to the population and substantially reduce the all-cause mortality gap between Māori and non-Māori (here).

To justify repealing the smokefreeAct, the incoming Minister of Finance pointed to its negative impact on the government’s budget, specifically the need to preserve tobacco excise as a revenue stream (NZ$ 1.67 billion in the 2022–23 financial year, about US$1 billion, or 1.5% of total taxation revenue) to fund income tax-cut promises made during the electoral campaign to middle and high income earners (here).

In our recent modelling study, we evaluated the potential economic effects of the combined tobacco endgame strategies included in the smokefree Act on government revenue and expenditure, and overall citizen income. Our analysis estimated that the rapid falls in smoking prevalence from implementing the smokefree Act, compared with business as usual, would generate substantial economic benefits for citizens (eg, US$22.4 billion less cumulative expenditure by citizens on tobacco by 2040 had the legislation been implemented in 2023) but $10.3 billion less cumulative tobacco excise tax revenue to government.

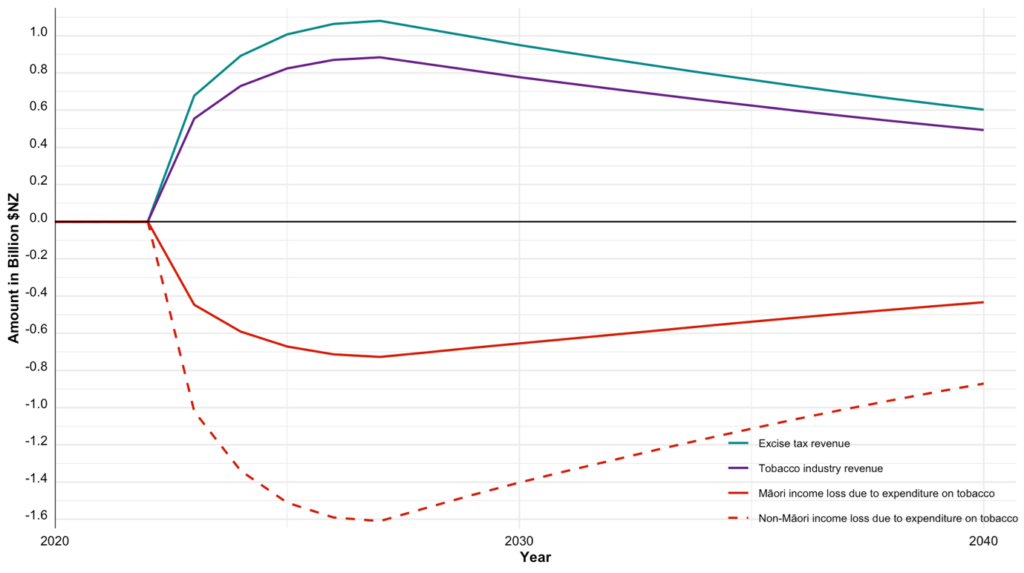

Figure 1 presents an extension to this analysis, showing the ultimate economic winners and losers resulting from the government’s decision. We estimated the annual increases in tobacco industry revenue, revenue to government from tobacco excise, and loss in disposable income for citizens as a result of expenditure on tobacco for Māori (17% of total population) and non-Māori.

Note: Amounts in 2021 New Zealand dollars with 3% annual discount rate. Tobacco industry is defined as wholesale, distribution and retail. Disaggregated estimates for Māori and non-Māori generated with our existing integrated epidemiological and economic model (methodological details here and here). Yearly tobacco industry revenue = yearly tobacco excise revenue (here) x ((1 – proportion of tobacco excise)/proportion of tobacco excise) (here). Annual projections estimated in the model as the difference between a counterfactual scenario in which the smokefree legislation remains in place and business as usual under which the legislation is repealed.

Repealing the smokefree Act would generate NZ$12.4 billion (95% uncertainty interval [UI], 9.9–14.7) in cumulative revenue for the tobacco industry by 2040, compared with a scenario in which the legislation remains in place. Approximately a third of that revenue (NZ$3.9 billion; 95% UI, 3.1–4.6) will be a transfer coming from the disposable income of Māori citizens.

High taxation of tobacco products (and subsequent government excise revenue) is one of the most effective policies to reduce smoking prevalence (here). It is also a progressive tobacco control strategy, as people on lower incomes, who often experience higher smoking rates, are more responsive to high cigarette prices — although for smokers who keep smoking, and do not reduce per day cigarette consumption, there is a high impact on disposable income.

Repealing thesmokefree Act preserves tobacco excise as a revenue stream for government but also benefits the tobacco industry by protecting the revenue it generates from selling smoked cigarettes to the Aotearoa New Zealand population. These benefits occur particularly at the expense of Māori who per capita contribute 2.3 times as much revenue from tobacco to both government and the tobacco industry. Given that people who smoke have on average lower incomes than those who don’t smoke (here), and Māori on average have lower income than non-Māori (here), repealing this legislation is a regressive way to pay for tobacco industry profits and the tax cuts planned by the new government.

The body of research informing the smokefree Act in Aotearoa New Zealand highlights the health, economic and equity gains that can arise from ambitious tobacco policy (and the lost opportunity if such policy is not pursued) (here and here). Achieving these gains takes strong leadership of civil society and governments. Moreover, from an economic perspective, beyond election cycles, dramatically reducing tobacco smoking makes sense because of the public health gains and consequent increased workforce productivity (here and here).

The Aotearoa New Zealand Government’s decision to repeal an carefully designed legislation, supported by tobacco experts globally and a large majority of the Aotearoa New Zealand population (here), has been described as an act of “public health vandalism” (here). Such a decision highlights how political short-termism and a lack of holistic thinking by governments can impede public health progress to the detriment of the health and economic wellbeing of the population.

Dr Driss Ait Ouakrim is a Senior Research Fellow at the Melbourne School of Population and Global Health, University of Melbourne.

Ms Samantha Howe is a PhD candidate at the Melbourne School of Population and Global Health, University of Melbourne.

Dr Tim Wilson is a Research Fellow at the Population Interventions Unit at the Melbourne School of Population and Global Health, University of Melbourne.

Professor Coral Gartner is a Director of the Centre for Research Excellence for Achieving the Tobacco Endgame at the School of Public Health at the University of Queensland.

Professor Tony Blakely is a Head of the Population Interventions Unit at the Melbourne School of Population and Global Health, University of Melbourne.

This project was supported by funding from the Australian National Health and Medical Research Council (GNT1198301).

The statements or opinions expressed in this article reflect the views of the authors and do not necessarily represent the official policy of the AMA, the MJA or InSight+ unless so stated.

Subscribe to the free InSight+ weekly newsletter here. It is available to all readers, not just registered medical practitioners.

If you would like to submit an article for consideration, send a Word version to mjainsight-editor@ampco.com.au.

more_vert

more_vert

Responding to “Anonymous”. I had considered the bounded rationality argument but subconsciously discarded it as paternalistic. But I take your point from a social preferences perspective, and it was to the “public health priority”, “social cost” and “aggregated harms” arguments, but interestingly and to your point, uses economic methods to support restrictive policy. Even if one bought the short-term view that allowing access to tobacco is welfare maximising, the long-term effect on health-related quality of life at best, cancels out the welfare gains. I guess there’s still a tension between the harm and liberty principles, and ACT as a libertarian part of the coalition has weighed personal liberty as more important. Post-COVID there’s a bunch of people concerned about overly restrictive public health policy, so it’ll be interesting to see where policy settles in the long term. And it’ll be interesting to see whether other policies will be libertarian-consistent…

Many years ago, the Australian economics of smoking were for each dollar of tax raised, thirty dollars needed to be spent on dealing with the health costs of smoking.

Now the UK has passed a similar law: “UK House of Commons passes bill to ban anyone born after 2009 from buying cigarettes”.

The next step in Australia is to have only licensed tobacconists sell cigarettes and vapes under supply regulations.

For some, the choice to imbibe nicotine is no longer a choice when addicted, but a continuing dependance on a product that ruins their health.

Responding to “Apolitical”…. arguments of “personal autonomy” to use tobacco don’t fit well with a product that most people who use it, would prefer not to. The following quotes are from the abstract from a classic paper that measured how people who smoke feel about their smoking (Fong GT, et al. The near-universal experience of regret among smokers in four countries: findings from the International Tobacco Control Policy Evaluation Survey. Nicotine Tob Res. 2004 Dec;6 Suppl 3:S341-51). “Regret may be a key variable in understanding the experience of smokers, the vast majority of whom continue to smoke while desiring to quit…The proportion of smokers who agreed or agreed strongly with the statement “If you had to do it over again, you would not have started smoking” was extremely high–about 90%–and nearly identical across the four countries… Among other implications for cessation treatment and smoking prevention, this near universality of regret casts doubt on the view of some policy analysts and economists that the decisions to take up and continue smoking are welfare-maximizing for the consumer.” 90% of people who smoke regretting starting to smoke doesn’t sound like ‘personal autonomy’ or ‘free choice’ to me.

Thalidomide wasn’t banned in the same sense and many years later has been reintroduced into practice for treatment of multiple myeloma. Thalidomide is more of an example of medical reversal (introduction of restrictions after approval to market), more similar to Vioxx than tobacco.

I guess medical practitioners once advocated for the health benefits of tobacco, but it’s been a long time since that’s been the case. The issue here is more down public health ethics- is the impact on personal autonomy of citizens (to choose to use tobacco) more important than the impact on other citizens of second-hand smoke, and on society in terms of the burden of disease. The NZ public health experts and previous Labour Government were clear on that. The current coalition government has a key dependency on a libertarian party, which thinks personal autonomy wins and so to be in power, National has agreed to roll back the ban.

Even medical dogma isn’t that straightforward in this situation- harm minimisation vs. prohibition. I guess the question will be whether the coalition government will apply that consistently (e.g. to cannabis and other prohibited drugs), or whether this is an anomaly which then plays into the pro-tobacco lobby conspiracy theories. The government is supporting derestricting pseudoephedrine and reducing regulatory barriers to medicine introduction in NZ, so there’s an argument to say that this is a consistent approach. There hasn’t been any word on their approach to psychedelics and cannabis yet, so we shall see…

Why not simply ban cigarettes altogether? We did it for Thalidomide, which in total numbers harmed far fewer people.

Tobacco is an addictive, dangerous drug, with no benefits. What is the point of drug and food regulation if such a drug/food can be sold?