For medical specialists and GPs, ownership of medical rooms within an SMSF provides you with a basket of benefits that cannot be found with any other investment.

In this article, Braith Morrow, Head of Advice at First Samuel, delves into the benefits and considerations associated with this strategic investment move.

For those who do not yet own their rooms, what are the advantages?

For those who do, there are significant problems arising from the proposed additional taxes on member balances greater than $3 million. These we shall deal with in Part 2, in next month’s article.

The advantages

There are many worthwhile benefits of owning your own rooms, including:

- Ultimate control rests with you;

- Long-term tenure security for practitioners, staff, and patients;

- Provision of both income (rent) and capital gain;

- Asset protection;

- Flexibility to change the property fit-out to suit your (and your patients) needs;

- Wealth preservation and creation avenues optimisation of tax structures.

However, we often encounter situations where the ownership of these assets is not structured in the most tax effective manner for long term wealth creation.

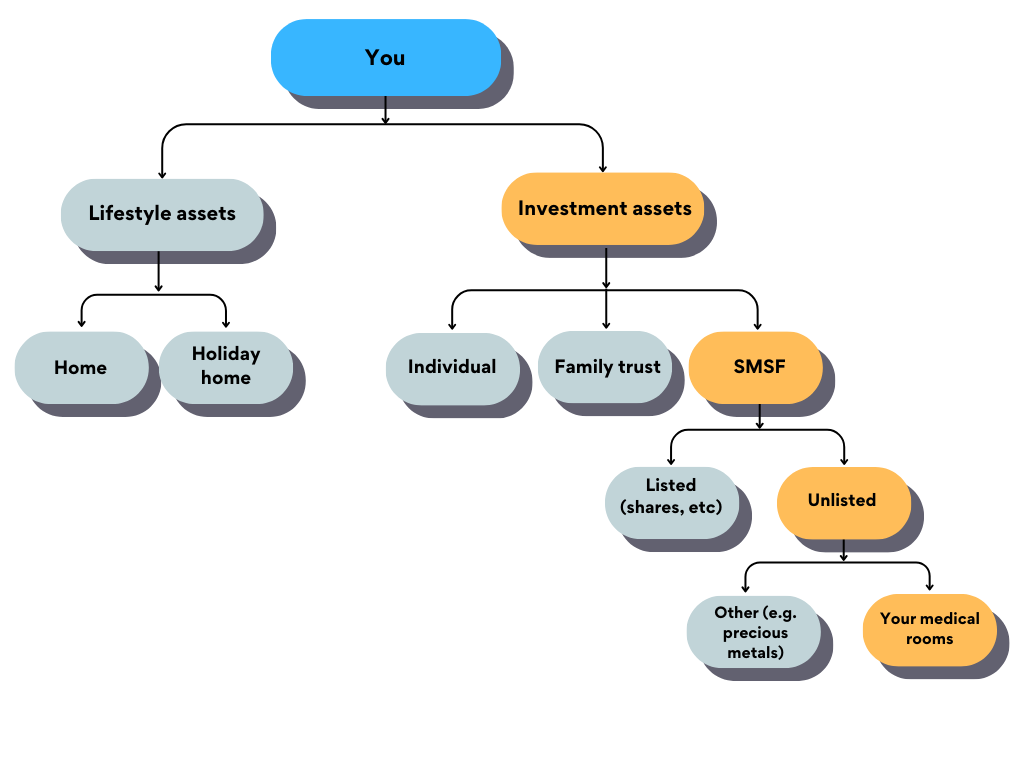

Companies, trusts, partnerships and personal ownership are all possible. Each ownership structure has its pros and cons. But it is superannuation that we are mostly asked about.

Superannuation: a closer look

Despite the impending tax changes that are set to take effect from 1 July 2025, for member balances below $3 million, superannuation remains an attractive concessionally taxed structure available to build up your wealth, especially if you have many working years ahead.

Maximising its benefits is a conscious decision to buy the rooms by either (a) using cash already in your SMSF or (b) transferring the rooms in over a number of years, using your annual superannuation contribution limits for use as a ‘real business property transfer’.

Additional considerations

The decision in which structure to hold your rooms should consider several other factors, including:

- Potential stamp duty on any asset transfer;

- Future intended/likely holding period;

- Land tax implications;

- Intended use during the life of the asset – future capital works and how they could potentially be undertaken and funded;

- Does the asset have current or future depreciation opportunities;

- Your estate planning intentions – there will be a further tax applied to the taxable component of a members residual superannuation balance eventually being paid to a non-dependent beneficiary (an extra 15%, plus Medicare levy unless distributed via your estate).

It is clear that comprehensive advice, including a break-even analysis between alternative structures, ought to be pursued.

Navigating pitfalls

Firstly, always remember that the ATO allows individuals to manage their own superannuation investments on the condition that the individual follows the rules. It is the responsibility of the trustee(s) of the fund to ensure that the rules are followed.

If you already have an SMSF you would be aware of these and how to manage them in conjunction with your wealth adviser and accountant.

Secondly, there are special rules for property investment in a SMSF. These include no ‘personal use’ of the asset, annual valuation requirements and maintaining commercial arrangements (no skipping, undercutting or overpaying rent). That’s before we get to the problems with even minor renovations (which effectively prohibit members from making repairs themselves).

Notably, using SMSF assets as security for personal or business borrowing is strictly prohibited. Also, you simply cannot afford to have your rooms as the only asset in your SMSF. In fact, the ATO, as the regulator of SMSFs, is often on the lookout for any such instances. There are also practical issues such as lack of diversification, need for liquidity, management of risks, etc.

Where to next?

Investing in your own medical rooms is a logical part of a cascading wealth management structure. But it’s important to ensure the benefits are balanced against the set-up costs, on-going costs and regulatory requirements.

First Samuel, with our expertise in serving the wealth management needs of medical specialists, provides tailored guidance to maximise the opportunities of placing your rooms in your SMSF. If you’re considering this strategic move, now is the time to capitalise on our knowledge and merge your curiosity with our expertise. Talk to us today.

Interested to know more? Read the case study on how we successfully implemented the above strategy for one of our clients.

Braith Morrow is the Head of Advice at First Samuel. Braith has 20 years of experience in the financial services industry. He has extensive experience helping businesses understand their regulatory and legislative obligations across Australian and New Zealand financial services operations. Braith is passionate about working with stakeholders to deliver client-focused outcomes while meeting and exceeding regulatory standards.

more_vert

more_vert